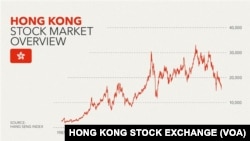

The Hong Kong Stock Exchange's benchmark Hang Seng index is having a rocky start to the new year, trading around the same level it was at when the British handed the city to Beijing 27 years ago and losing its place as the fourth-largest capital market in Asia to India. Last year it was the worst-performing major market in the world.

The Hang Seng has been trading below 16,000 points, declining in value for about 90% of the trading days so far this year.

On January 22 alone, the Hang Seng dipped sharply to 14,961 points, below the psychologically sensitive 15,000 mark and hitting a 15-month low.

Alicia Garcia-Herrero, chief economist for Asia Pacific at French investment bank Natixis, said the index reflects investors' disappointment in the Chinese economy. Based in Hong Kong, Garcia-Herrero told VOA, "The years of high growth for the Chinese economy are over, and investors are fully aware."

China's economy has been struggling to recover from strict COVID-19 pandemic lockdowns and restrictions that wreaked havoc on trade, sparked rare public protests against the government and ended only in late 2022. A collapsed property market and shrinking population have added to the woes.

Chinese equities have fallen by more than U.S. $6 trillion in value from a 2021 high while Hong Kong's market is getting fewer newly listed companies through initial public offerings.

Chung Kim-wah, a retired assistant professor in the Department of Applied Social Sciences at Hong Kong Polytechnic University, described the city as the ruins of an international financial center.

Almost all economic indices in Hong Kong are performing poorly, he said, with high office vacancy rates, falling building prices and the withdrawal of foreign funds. He also cited reductions in the number of international institutions maintaining their headquarters in Hong Kong and personnel of foreign institutions stationed in the city.

Chung said the only bright spot is Hong Kong's unemployment rate, which is holding steady at less than 3%

"But now because some people emigrated, [the jobs] they left behind can be filled immediately, which is why the unemployment rate has not risen significantly with the outflow of funds," he said. "So, in fact [Hong Kong] is already in ruins. But now we have to wait and see when it will reach the bottom."

Analysts say Beijing's strengthening grip on dissent is also fueling the city's decline.

The Beijing-installed Hong Kong Chief Executive John Lee Ka-chiu aims to complete controversial security legislation this year that will allow more prosecutions for treason and theft of state secrets.

"National security risks are real," he said during a question-and-answer session in the Legislative Council on January 25, emphasizing that the law should be completed "as soon as possible."

Once national security risks are eliminated, he said, Hong Kong can focus on boosting the economy, expanding markets, exploring business opportunities and improving people's livelihoods.

However, Lew Mon-hung, a former member of the Chinese People's Political Consultative Conference, a political advisory body in the Chinese government, said China's long-arm control of the city will cause more capital flight as investors become increasingly pessimistic about Hong Kong's long-term economic development.

"Hong Kong's stock market is built on the cornerstones of freedom and the rule of law," he told VOA. "If you go to destroy Hong Kong's freedom and rule of law, then you will drain the foundation of its stock market."

Li Chen-yu, chief economist of Taishin Financial Holding Co. in Taipei, said, "China should first go through economic and then political affairs. It should stabilize China's economy as a whole and then discuss so-called political stability. When the economy is unstable, forcefully promoting so-called political stability could be counterproductive."